PrizePicks integrates Kalshi prediction markets

Daily fantasy sports operator PrizePicks has announced a prediction-markets feature within its app, thanks to a new deal with prediction market company Kalshi.

The new prediction markets are offered through Performance Predictions, a federally approved Futures Commission Merchant, which means that PrizePicks can list federally regulated event contracts.

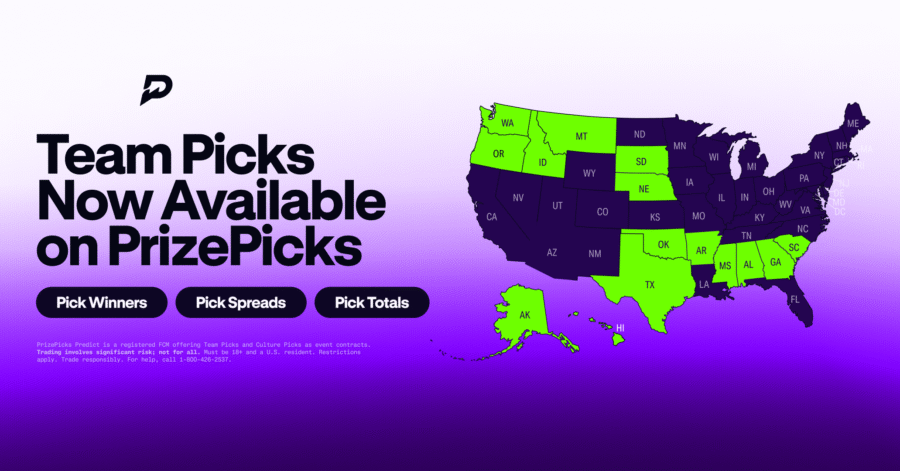

The integration will allow users to make predictions on outcomes in sports, entertainment, and cultural events from Kalshi’s catalogue of markets. The rollout extends across 38 states and Washington, DC, and will significantly increase the types of events with which PrizePicks users can engage.

The service also will include two new categories of prediction products: Team Picks and Culture Picks.

Team Picks will enable customers to forecast the results of games and season-long events, including win totals or playoff appearances. Culture Picks will focus on awards shows, elections, and other non-sports events.

“Expanding into prediction markets delivers on what our customers want, innovative products with more ways to play,” Mike Ybarra, PrizePicks CEO, said in a news release. “Together with Kalshi, we will welcome new customers across many states to the PrizePicks experience, and we couldn’t be more excited about the opportunity ahead in this fast-growing space.”

The partnership with Kalshi follows an announcement last week that PrizePicks would partner with prediction market rival Polymarket, allowing users to engage with Polymarket’s event contracts on the PrizePicks app.

Charlotte Capewell brings her passion for storytelling and expertise in writing, researching, and the gambling industry to every article she writes. Her specialties include the US gambling industry, regulator legislation, igaming, and more.

Verticals:

Sectors:

Topics:

Dig Deeper

The Backstory

Why this pivot matters now

Daily fantasy’s push into event contracts has been building for months as prediction markets gain regulatory footing and consumer traction. PrizePicks’ move to integrate a federally regulated exchange reflects a broader migration of sports and culture wagering into derivatives-style products that can be offered nationally under federal oversight. The strategy aims to widen the slate of markets beyond player props to outcomes such as season wins, award races and election results, reshaping how U.S. fans interact with uncertainty and data. The backdrop is a fast-evolving legal map that treats event contracts as commodities products when listed through regulated venues, a framework that can bypass state-by-state sports betting rules and taxes. That distinction is central to how operators expand while regulators test the limits.

The shift gathered momentum as prediction platforms established beachheads in U.S. markets and courtrooms. Early entries in sports event contracts and a string of legal decisions set the stage for larger consumer platforms to plug into federally supervised pipes. The stakes are substantial: a nationwide, app-native product with fewer jurisdictional breaks could redraw competitive lines with sportsbooks and spur new revenue streams tied to volatility in sports and culture.

A dual-track push into event contracts

PrizePicks previewed this direction with a separate tie-up that would pull in event contracts from another market operator. Its multi-year pact with Polymarket signaled intent to distribute a wide range of contracts inside a single app, pairing daily fantasy’s audience with the prediction market format. The arrangement was notable for what it said about infrastructure and compliance. Polymarket’s pathway back into the U.S. hinged on acquiring a CFTC-licensed exchange and clearinghouse, QCEX, positioning it to supply contracts through federally regulated rails. Read more on that strategy in PrizePicks partners with Polymarket to launch prediction markets in the US.

The two-pronged approach — integrating contracts from multiple providers — reflects a race to inventory. Operators want deep catalogs across sports, entertainment and politics to anchor daily engagement and to smooth activity across the calendar. For consumers, a unified interface lowers friction versus opening specialist apps. For the companies, it concentrates liquidity and data in a single experience with cross-sell potential into fantasy contests.

State resistance meets federal preemption claims

As offerings expand, state regulators have challenged the premise that event contracts sit outside their authority. Kalshi has become a key test case. In Maryland, the company sued to block a cease-and-desist order, arguing the federal commodities regime preempts state gambling rules for contracts listed on designated exchanges. The complaint asks for preliminary and permanent relief to keep operations live while the legal questions are resolved. The filing followed similar clashes elsewhere and a temporary injunction in Nevada that the company said would sharpen the legal contours of its model. For details on the Maryland action, see Prediction markets platform Kalshi files lawsuit in Maryland.

These disputes turn on taxonomy. If an event contract is a federally regulated swap or derivative, CFTC oversight governs and state sports-betting statutes do not apply. If it is gambling by another name, states can assert control and levy taxes. The answer will shape where and how operators can scale and whether national distribution through a single app becomes feasible without a patchwork of state licenses.

Washington’s role and the CFTC’s expanding docket

The regulatory center of gravity is also shifting in Washington. The CFTC’s stance on event contracts — including elections and sports — has grown more consequential as market volume rises and mainstream platforms look to integrate. A recent Senate confirmation hearing spotlighted the issue when lawmakers probed a CFTC nominee about ties to an exchange operator and the broader implications for conflicts and policy. The nominee, a former commissioner and current board member at a prediction platform, told senators he would divest if confirmed and cast event contracts as useful hedging tools in a modern economy. Coverage of the hearing is here: Kalshi director and CFTC nominee advocates for prediction markets.

Personnel and policy at the CFTC will determine how quickly new products clear review, where lines are drawn on categories like elections and sports, and how market integrity and consumer protections are enforced. That guidance, in turn, influences whether app-level integrations can scale nationally or must remain limited pilots.

Sports markets break through

The product frontier moved meaningfully in January when a leading events exchange began listing sports contracts with “will team win title” formats. The launch followed a filing with the CFTC to permit sports predictions on major events and arrived as other platforms tested Super Bowl markets. The rollout illustrated a willingness to list sports alongside macro and cultural outcomes under the events umbrella, even as regulators scrutinized the boundary with sports betting. For background, see Prediction market Kalshi launches event contracts on sports.

That opening set up distribution partnerships with consumer-facing apps that already command large sports audiences. By combining sports titles, season win totals and award races with off-field markets like elections or pop culture awards, providers can reduce seasonality and increase session frequency.

What’s at stake for operators, states and consumers

The economic stakes are clear. For operators, federally regulated event contracts offer a path to national scale with lower customer acquisition costs and richer engagement loops than state-by-state sportsbooks. For states, the model raises questions about lost tax revenue and oversight of products that look and feel like wagering. For consumers, cross-category menus promise breadth and price discovery, but they also require guardrails on marketing, suitability and dispute resolution commensurate with financial products.

The legal outcomes in Maryland and other jurisdictions will influence how aggressively platforms roll out sports and culture contracts and whether more daily fantasy operators follow with similar integrations. CFTC leadership and policy will set the boundaries on what categories can list and how exchanges supervise risk. Against that backdrop, distribution deals with large fantasy apps are a logical next step, knitting together audience scale with the federally supervised infrastructure event markets need to grow.