Prediction market coalition brings on former Congress members

A newly formed industry group advocating for prediction market platforms has revealed the addition of two high-profile former US lawmakers to its leadership team.

The move underscores the growing political push behind this emerging sector, as battles continue in the US court systems between state regulators and prediction market operators regarding who has the right to regulate sports event contracts.

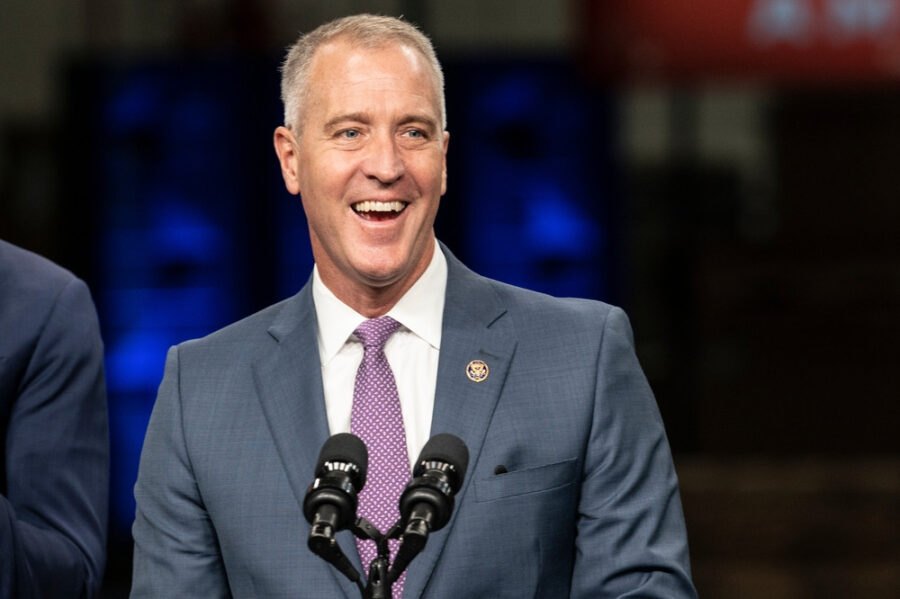

According to a report by Axios, the Coalition for Prediction Markets announced on Wednesday that Sean Patrick Maloney, a Democrat who has served 10 years in the US House of Representatives, will assume a new role with the group as President and Chief Executive. Meanwhile, former Republican representative Patrick McHenry will join the organization as a Senior Advisor.

The move is a show of force by the coalition as it aims to ensure that the regulations governing its market remain under federal control rather than state control.

Currently, notable prediction market platforms like Kalshi and Robinhood are embroiled in legal battles with several states that accuse them of offering sports gambling contracts without a license.

Most recently, a federal judge temporarily blocked Tennessee’s attempt to stop Kalshi’s operation in the state with a preliminary injunction hearing scheduled for January 26.

Speaking about the future of these markets, McHenry said, “Prediction markets have long operated within a federal regulatory framework designed to promote transparency and protect consumers. As these markets continue to grow, it’s critical that both consumers and platforms have clear and consistent guidance.”

Charlotte Capewell brings her passion for storytelling and expertise in writing, researching, and the gambling industry to every article she writes. Her specialties include the US gambling industry, regulator legislation, igaming, and more.

Verticals:

Sectors:

Topics:

Dig Deeper

The Backstory

Why this fight over prediction markets is accelerating

The addition of two former House members to an industry coalition reflects a broader effort to settle who governs event-based trading as states move to assert gambling authority and platforms push for federal purview. Over the past year, prediction markets have expanded beyond politics and macro to sports-like contracts that resemble wagers, triggering a fast-rising clash among exchanges, casino regulators and Congress. The Coalition for Prediction Markets formed to argue that federally supervised event contracts should not be subject to 50 different state gambling regimes, setting up a test of jurisdiction with implications for market structure, consumer access and growth.

Momentum for a coordinated push has been building as state agencies from Connecticut to Nevada signaled they view sports event contracts as wagering. Platforms and their backers contend the Commodity Futures Trading Commission already regulates these markets and can set integrity and consumer protection standards. The timing matters: litigation calendars are filling, trading volumes are surging and new entrants with federal licenses are circling the space.

A unified industry bid for federal oversight

Kalshi and Crypto.com convened the Coalition for Prediction Markets with Coinbase, Robinhood and Underdog to press for federal oversight and to counter state efforts to classify event contracts as gambling. The group cited polling that voters prefer federal rules and pointed to industry figures indicating nearly $28 billion in trading volume through October. It warned that conflicting state directives could fragment compliance and push users offshore. Early priorities include harmonized integrity standards, such as insider-trading protections, and consistent supervision.

The coalition launched after several state regulators stepped in. Connecticut ordered providers to halt sports event contracts and Nevada’s gaming authority clarified it regards such contracts as wagering even when listed on federally regulated exchanges. The coalition argues that a federal framework can deliver transparency and access while addressing consumer risks without splitting the country into incompatible regimes.

Casino and tribal groups press Congress to draw a line

The American Gaming Association and Indian Gaming Association urged lawmakers to intervene, framing sports event contracts as indistinguishable from sports betting and calling out rapid product expansion since January. In a joint letter, they argued platforms exploited regulatory inaction at the CFTC and warned of encroachment on state-controlled gambling policy. They also cited a controversial market tied to the capture of Venezuela’s president as evidence of lines being crossed. The trade groups want Congress, which is weighing cryptocurrency market structure legislation, to reinforce that gaming cannot be offered through the CFTC’s event-contract regime and to set clearer boundaries for digital asset and derivatives markets.

Their push comes as CFTC Chair Michael Selig signaled the commission would not unilaterally rein in sports event contracts but would follow congressional direction. That places Capitol Hill at the center of the next phase. Any statute that delineates gambling from event-based derivatives would shape who regulates what, who can list which contracts and how consumer protections are enforced.

Platforms gear up with capital, talent and licenses

Market leaders are positioning for scale and legitimacy. Kalshi named former Uber finance executive Saurabh Tejwani as its first CFO as it expands nationwide and weighs longer-term options, including a potential IPO. In announcing the hire, Kalshi emphasized Tejwani’s experience in dealmaking and international expansion, following a major capital raise in October that lifted its valuation to $5 billion. The firm’s growth has drawn scrutiny, including blowback over job ads that referenced “sportsbooks,” a term at odds with its argument that event contracts are not gambling, though the posting was later revised. Read more on Kalshi’s finance buildout in Kalshi appoints former Uber executive as first Chief Financial Officer.

Crypto and trading firms are also moving to secure federally supervised venues. Kraken agreed to buy CFTC-licensed Small Exchange for $100 million, a move it said will underpin a U.S.-native derivatives platform spanning spot, futures and margin and, critically, set the stage for a prediction market entry. The deal highlights how CFTC licenses have become strategic assets for companies angling to list event contracts onshore or to legitimize offerings in adjacent markets. Daily fantasy operator PrizePicks secured National Futures Association approval for a subsidiary to launch predictions, while sports betting exchange RSBIX refiled to be a designated contract market. Details are in Kraken eyes prediction market launch with acquisition of CFTC-licensed Small Exchange.

Polymarket’s reach and the battle for consumer mindshare

Polymarket, founded in 2020, has been central to consumer adoption. The company reported more than $8 billion in 2024 predictions across politics, culture and news, and this year it partnered with X to integrate prediction probabilities with Grok analysis and real-time social data. The tie-up aims to surface instant, context-rich signals to millions of users, underscoring how distribution and data can drive engagement. See Polymarket ties up with X as official prediction market partner for the roadmap behind the integration.

External analyses point to a breakneck growth curve. One study estimated Polymarket’s 2024 activity at $9 billion with more than 314,000 active traders, redefining the reach of prediction markets globally. The figures add urgency for regulators and lawmakers weighing whether these products are financial instruments with social utility or gambling by another name. Read the market snapshot in The Block’s year-end analysis.

What to watch as jurisdictional lines are drawn

The regulatory map is now a three-front contest: federal regulators asserting authority over event-based contracts, state gaming bodies defending gambling prerogatives and Congress considering whether to codify boundaries. The coalition’s expansion, with bipartisan political heavyweights, signals an intent to influence the Hill while platforms fortify with capital, compliance and licensing. Meanwhile, casino and tribal groups are pressing lawmakers to treat sports-aligned contracts as betting and to lock them under state control.

Key near-term catalysts include court rulings on state attempts to restrict listings, congressional progress on crypto market structure and any CFTC actions clarifying what can be listed under existing rules. Competitive dynamics will also evolve as Kraken integrates a CFTC venue, Kalshi refines its product mix and Polymarket broadens distribution through X. The stakes are high: the outcome will determine where Americans can trade predictions, which products are allowed, how consumer protections are enforced and whether the market consolidates under a single federal framework or fragments across state lines.