PayNearMe attacks failed payments with Payment Experience Management

Since the repeal of the Professional and Amateur Sports Betting Act in 2018, sports betting has flourished in the United States. Opportunities for igaming also have increased. Patrons also have the option to indulge in predictive markets and sweepstakes. But despite all the innovation in player acquisition and onboarding, operators are still grappling with one costly and persistent issue: failed payments.

While onboarding experiences have become more streamlined, failed deposits plague the industry, undermining profitability. And that’s because of the complexity of online transactions that involve betting.

“It’s a high risk, highly regulated industry —much more difficult to manage than the payment experience at Amazon,” says PayNearMe Vice President & General Manager, iGaming & Sports Betting Leighton Webb. “Friction is the most pressing problem.”

That friction isn’t just player-facing. Webb explains that internal inefficiencies — such as managing chargebacks and payouts create expensive and time-consuming challenges for operators.

Data gathered by PayNearMe indicates the loss of revenue can increase dramatically. When conducting consumer research, the company found that 23% of players abandon a betting app permanently after a failed deposit and that 32% of players delete the app if funding takes too long. Also, 44% abandon apps that are too glitchy or unresponsive.

Webb says operators routinely reach out with alarming figures.

“Anecdotally, we get calls regularly where an operator says, ‘hey, we lost a huge chunk of money to chargebacks,’ ” he says. “And they now realize it’s a problem because they weren’t proactively thinking about it.

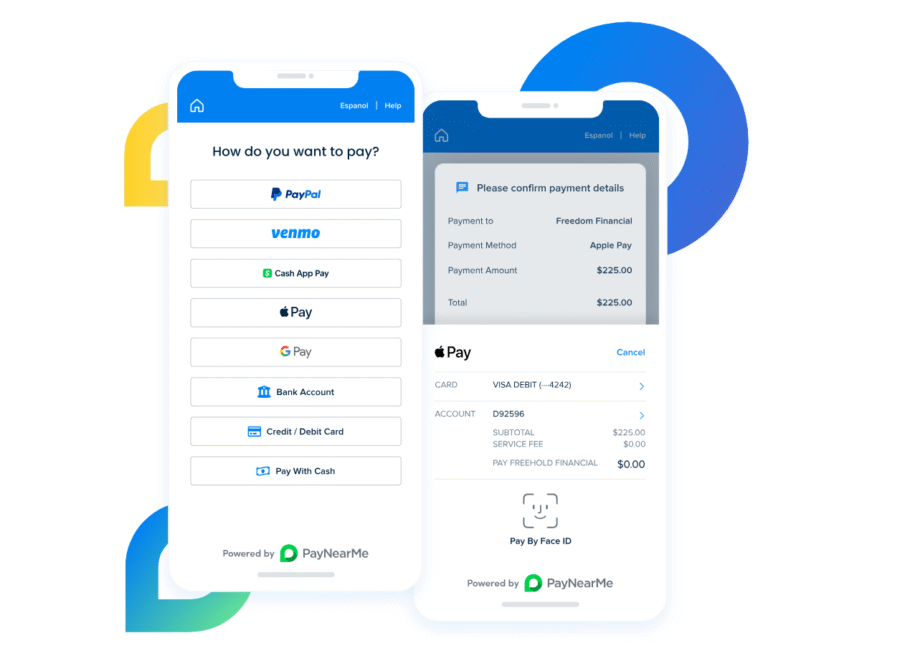

To address these hidden cost drivers, PayNearMe developed Payment Experience Management — a proactive approach to reducing friction throughout the entire payments journey.

“Payment Experience Management covers everything from deposit failures and chargeback risk to internal ops, data visibility, and fraud prevention,” Webb says. “Why does that matter? Because all of those inefficiencies drive up acquisition costs and eat into operator margins.”

It does seem odd that after so much time and money has been invested by so many operators that there are glitches in onboarding. Webb says the biggest problems are simple to fix, but hard in practice to do.

Simply, too many operators “don’t think about it,” Webb says.

While most operators focus on the cost of the tender, for example, card or ACH fees, Webb says they often overlook cost drivers like support overhead, fraud losses, and exception handling.

“They’re not putting enough time or thought into what their risk tools look like, or how their back office is set up to manage payments efficiently,” he says. “You can add bodies, but it doesn’t scale well — and it gets expensive fast.”

PayNearMe combats fraud through their partnership with Accertify, a risk management tool that enables them to score every transaction that comes through its system in real-time.

“It’s a robust, automated system that flags whether a transaction should be accepted or rejected,” Webb explains. “That level of automation helps operators move away from manual reviews and toward scalable, consistent fraud mitigation.”

Webb thinks operators need to reframe how they think about payments — not as a cost center, but as a performance driver.

When operators go beyond thinking about the transaction cost alone, they can start seeing how other payment-related cost drivers such as fraud, exceptions, overhead and disparate systems can start eroding their bottom line,” he says. “With a payments platform that holistically addresses all of these cost drivers, operators can start lowering their total cost of acceptance.”

Verticals:

Sectors:

Topics: